Table of Content

If you allow the provider to monitor your driving habits via the installed device or the mobile App, you may be rewarded with a lower monthly premium, points that can be used to redeem gift cards and gifts on the company website. You can put your money as long-term investments with these relatively save plans being managed by partnered financial advising companies. Like all other plans, you may be eligible for various discount programs such as the multi-policy discount, easy pay plan, homeownership discount, full-pay discount, and boat education discount. You can receive a 5% discount when you set up automatic withdrawal payment option.

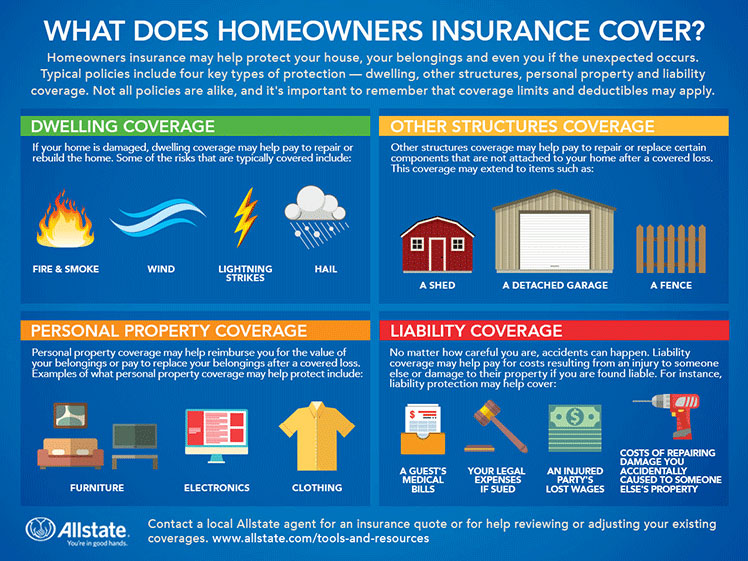

Pays the difference between the insured value that includes depreciation and the finance or lease price. It reimburses the expenses related to the towing of the motorcycle for failures or accidents. Covers by reimbursement the rent of a car in which the injured is under repair. It protects you against damages caused to third parties in their property or people and for which you are legally responsible. Protect your vehicle against damage caused in an accident.

Condominium Policy

If you are a good driver who actively engages in defensive driving habits, you are very unlikely to be the one at fault for causing an accident. If you are involved in an accident, you are most likely to be the non at-fault party. So adding the accident forgiveness option does not give you more value to your coverage.

Yes, you can cancel your policy with the provider at any time. Allstate does not have a cancellation penalty fee policy, so you will not be charged a fee for the process. And if you have already paid your policy in full, they will refund you for remainder of the policy back without any penalties.

Frequently Asked Questions about Insurance Allstate Insurance

Finally, when you pay your bill online or by phone, you will receive a unique reference number that will not be repeated. Insurance that covers the money and values of your business both within the facilities and outside of them, either in transit for deposits or payments, as in the homes of the employees in charge. Temporary protection against loss of income due to disability, in which the worker’s state of health is restored. It pays for the damages caused to the other vehicle and various properties in accidents under its responsibility.

To compensate this problem, you can purchase a supplemental health insurance coverage through various health insurance providers. Along with continuous rate hikes and premium rate increase due to at-fault claims, these are the reasons why many individuals have switch over to other competing insurance companies such as GEICO, Farmers, and Progressive. Your insurance premium rate increase is dependent on several factors. Usually when you file a claim and you are not at fault for the accident, you would not get an increase on your premium rate.

Allstate’s Weaknesses

Please note that if you choose the repair option, the provider will pay the designated repair shop directly. If your repair shop discovers more internal damage, your provider will also pay for those repair and replacement fees. However, if you choose the “cash out” option, the provider will give you a settlement check send you a check in the mail or through direct bank deposit. If you then choose to repair your vehicle at a repair shop of your own choice, and they discover more repair is needed, you will be responsible for the fee. Your provider will not reimburse you for the extra repair and replacement.

Use the Allstate Mobile App on your smart devices to get help with the Accident Toolkit gadgets and file your claim. Log into your online account to file a claim, upload the evidence information, and track the progress. Any liabilities that are connected to an oral and/or written contract are not covered by your PUP plan. These long-term investments allow you to invest your money towards your retirement savings with tax-defer benefits. Teenagers can earn up to 10% off the policy if they successfully finish the TeenSMART driver education program. 10% discount can be given to individuals who are 55 years old or older and are retired.

This program has proven to be one of the most successful education tools of Allstate. Surveys have indicated that ever since the introduction of this program, teenage traffic fatality rates has dropped 48%. Out of all the insurance services, the auto insurance sector is probably the top if not greatest strength of Allstate. As one of the largest insurance providers in the United States, Allstate has a huge team of agents and adjusters to handle claims on a daily basis. And they have a National Catastrophe Team ready 24/7 to immediately deal with major natural disaster events such as tornadoes, floods, hurricanes, and earthquakes.

When your vehicle hits another object, or overturns in an accident, you may be covered with collision insurance. Safe drivers, young drivers with no accident history, and drivers with great credit history. Wherever your travels take you, make sure you’re covered along the way. Avoid unexpected and costly medical fees with TripMate® Travel Insurance, available through Allstate’s provider, TuGo. Remember that policies are billed separately and must be paid in the same way.

If you have the basic coverage plans without any add-on coverage, you will be required to pay a deductible EVEN when you are not at fault for the accident. However, when Allstate recovers the damage payments and your deductible fees, you will receive a reimbursement along with the damage and repair costs. If the provider is unable to recover your deductible, you still have the option to chase after the fee by contacting the at-fault party provider or even go through the legal process should you feel the need. Before deciding to purchase an event insurance, please consult with an agent to ensure that your event can be insured. Many people do not have enough benefits through their work-covered health insurance.

In fact, most flood insurance is written through the NFIP, administered by the Federal Emergency Management Agency . It normally takes 30 days from the date of purchase to go into effect. So don't wait until a flood is imminent to buy a policy. Protect the roof over your head and everything under it, including your sense of security, with manufactured home insurance from State Farm®. We’ve got your personal property and your personal liability covered. You provide either a phone number, policy number, payment plan account number or key code along with date of birth and we’ll fetch your bill online.

Even though it may be tempting to make your decision based on the premium rate, you should really consider whether the plan will sufficient cover you in cases of accidents. At the same time, you should make sure that the insurance provider is a well-established company that has a strong financial strength rating and a great customer satisfaction grade. When choosing a plan, you must look past all the advertisement gimmicks and attractive promises, and investigate the reviews from other customers. This process will truly minimize the claim filing headaches in the already stressful situation and get back to your life as quickly as possible. Allstate has a small gradual increase in revenue in the past 5 years.

Protection that covers medical expenses that are necessary for the motorcycle driver and his companion. Covers medical expenses for injury or death and loss of income to the other driver. Additional protection that is used when your legal assistance coverage has been exhausted and you are subject to legal or judicial demands for excessive time and expenses above normal in cases of accidents. But, you still may be able to purchase flood insurance if your community participates in the National Flood Insurance Program .

No comments:

Post a Comment